As a business owner, you’re bound to face the need to deal with your estimated taxes at some point. In the context of tax reporting, this refers to tax that’s not subject to withholding from regular income such as wages. At the very least, you will need an accurate online tax calculator, as well as precise records. Most business owners opt to hire a tax professional but the savviest of these owners will go about it on their own. Here’s how to pay federal estimated taxes online using Form 1040-ES.

What Is 1040-ES?

Form 1040-ES, also commonly known as the estimated taxes form, is a form introduced by the US Internal Revenue Service to help you figure out the amount of tax due on your income. The primary purpose is to ensure that you pay the taxes in time and in full. Otherwise, you might have to pay a penalty.

1040-ES could be more accurately described as a package rather than a single form as it consists of several sections, including instructions, reference materials for calculating the amount of estimated tax to pay, and estimated tax payment vouchers. This is all you need to calculate and pay your estimated taxes over a certain year.

The IRS provides a variety of payment methods to choose from. In this article, we’ll focus on how you can pay online and various aspects of 1040-ES electronic filing. Alternatively, however, it’s possible to pay by check or money order. Cash payments are also accepted.

Who Needs Form 1040-ES?

Generally, estimated taxes have to be paid by those whose income is not subject to tax deductions like that of regular employees. Self-employed people are in a large group within the audience of Form 1040-ES. As a business owner, you don’t have an employer who’d be responsible for deducing your taxes and thus are expected to take care of them on your own.

Apart from independent contractors and business owners, Form 1040-ES 2022 edition is to be completed by the following categories:

- those receiving bank interest income;

- people who receive income on dividends;

- property owners who make a profit by renting it out, i.e., generate rent income;

- those receiving certain types of alimony as income;

- unemployed people receiving unemployment benefits;

- people receiving social security income (this only applies to a part of it).

Note that the category that you qualify for is determined for a particular reporting year based on your income patterns within the respective period.

Form 1040-ES Instructions

If you find that you are expected to complete Form 1040-ES in order to calculate and pay your estimated taxes as a self-employed person or part of any other of the above categories, the most time-efficient way to do it is online.

You can visit the IRS website or simply look for a fillable PDF template of the form. Just make sure it’s the current year’s edition to avoid inaccuracy in instructions. The package consists of twelve pages, two of which are blank and marked accordingly.

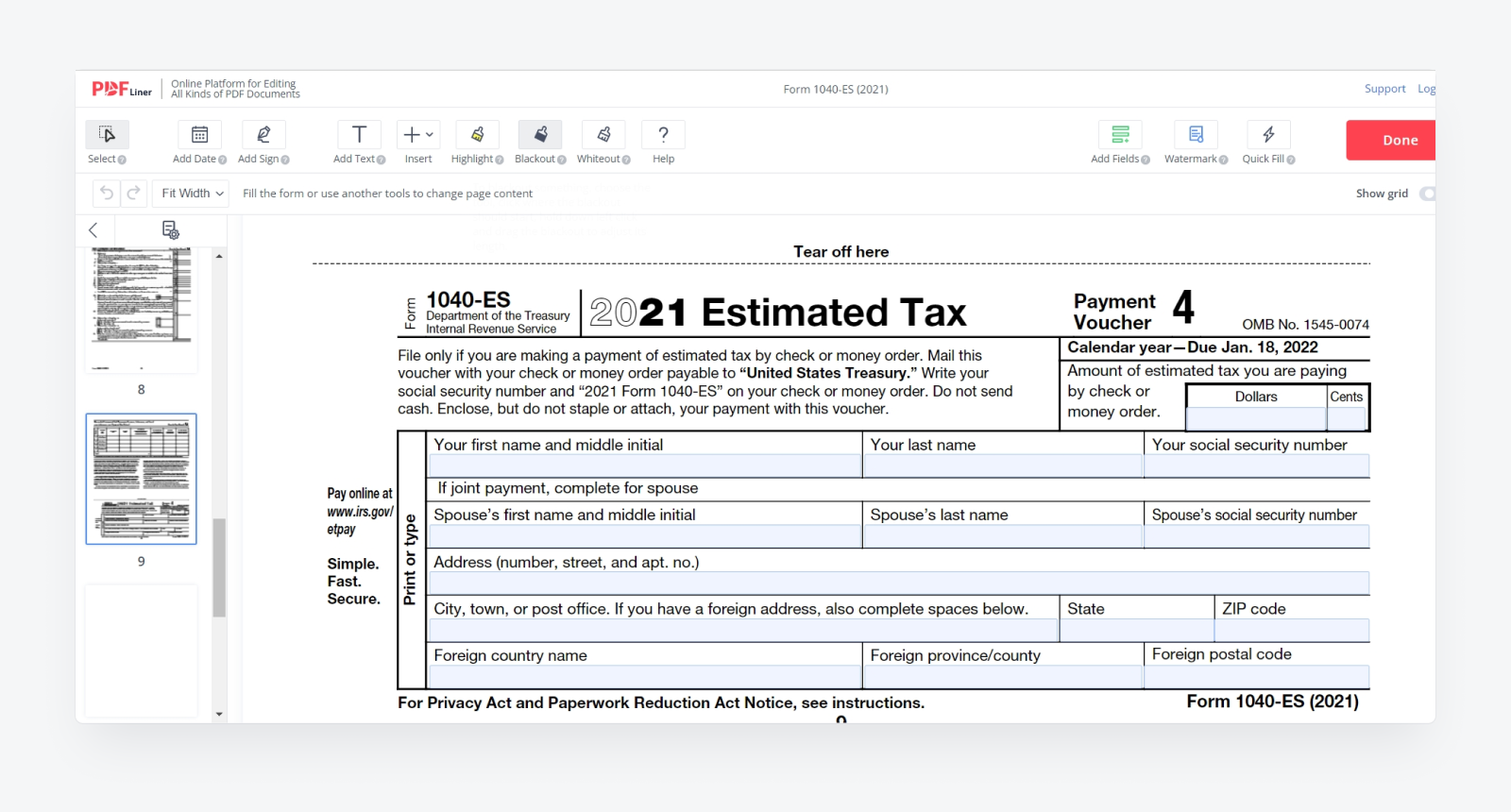

It contains official instructions on how to complete the form and pay your taxes, the Self-Employment Tax and Deduction Worksheet for calculating your income, the Tax Rate Schedules to inform you when figuring the estimated tax, the Estimated Tax Worksheet, the Record of Estimated Tax Payments for your own record keeping, and four payment vouchers to be used with money orders or checks.

When completing form 1040-ES online, start by reading the instructions and working out the tax deduction for your income. Use the results when completing the Estimated Tax Worksheet. The instructions on how to calculate the amount due are included in each line.

Fill out the Record of Estimated Tax Payments every time you make a payment, entering the amount due and paid, date paid, payment method, overpayment credit from last year, if any, and total amount paid and credited.

You won’t need the vouchers enclosed to pay online. To effect payments, go to the Payments section on the IRS website or use the service’s IRS2Go mobile application. The latter supports direct payments as well as payments by card.

When to File Form 1040-ES?

The estimated taxes form is not exactly a form that you file. Rather, it’s an instrument to help you with your payments, which means you complete it beforehand following the estimating procedure. Consequently, you might need to make up for the deficit in case you underestimate your taxes heavily or get a tax refund later if it turns out you overestimated your income for the year.

For those who like to keep things simple, there’s a possibility to pay the entire amount due by April 15, 2022. Note that there’s nothing to prevent you from doing it earlier. For those who prefer to pay in multiple installments, the 2022 schedule is as follows:

- pay on April 15 for income made from January 1 to March 31, i.e., the first quarter;

- pay on July 15 for April 1 to May 31;

- make the third payment on September 15 to cover June 1 to August 31;

- pay on January 15, 2023, for income made from September 1 to December 31, 2022.

It’s not a problem if you want to use even more installments, the instructions say.

Simplify Your Tax Paying Procedure with 1040-ES

The IRS Form 1040-ES is a convenient package for figuring out the amount of tax you’ll need to pay over a given year. While mostly applicable to self-employed people, it may also be used by other groups of taxpayers. The form provides online direct payment, payment by card, and other methods.

Do you feel like paying online, or do checks/money orders sound more reliable to you? You’re most welcome to share your thoughts in the comments.

Based on article from pdfliner.com